Creating Engaging and High-Performing UX for Insurance Quote and Buy Journeys

In the digital age, the user experience (UX) of your insurance quote and buy journey can significantly impact your business’s success. For product owners in the insurance sector, creating an engaging and seamless user journey is crucial to converting potential customers and improving sales performance. This blog post will outline the typical challenges faced in insurance quote and buy journeys and why users often do not convert. We will then share an anonymised case study of a global travel and health insurance company to illustrate how we addressed these challenges and enhanced their user journey.

Common Challenges in Insurance Quote and Buy Journeys

1. Complexity of Forms

One of the most significant barriers to conversion is the complexity and length of the forms users must complete. Many insurance quote and buy journeys require extensive information, which can be overwhelming and time-consuming for users. This complexity often leads to high abandonment rates.

2. Lack of Clarity and Comprehension

Insurance products are inherently complex, and users often struggle to understand the coverage options and what they entail. Poorly explained product details and jargon-heavy language can leave users confused and unsure about which product best suits their needs.

3. Generic Experience

A one-size-fits-all approach does not resonate with users whose insurance needs can vary widely. For example, a doctor travelling to Africa has different insurance concerns than a student studying in the UK. A generic experience fails to address these individual requirements, making users less likely to convert.

4. Unnecessary Data Collection

Many insurance companies ask for detailed medical histories or other extensive information upfront, which can deter users. Competitors offering simpler processes with less initial data collection can appear more attractive.

5. Lack of Educational Support

Users often lack knowledge about the medical costs and risks associated with their destination. Without educational support to guide them through the process, users may feel uncertain about the level of cover they need, leading to decision paralysis and abandonment.

Why Users Don’t Convert

Understanding why users abandon the quote and buy journey is crucial for improving conversion rates. Here are some key reasons:

- Overwhelming Information Requirements: Users are put off by long and complex forms asking for detailed personal information.

- Confusing Product Options: When users cannot easily differentiate between product options, they are less likely to make a purchase.

- Perceived Lack of Relevance: If the products and options do not seem tailored to their specific needs, users may feel the insurance is not suitable for them.

- Time-Consuming Process: Users today expect fast and efficient online experiences. A slow, cumbersome process will lead to higher drop-off rates.

- Insufficient Guidance: Without clear guidance and support, users may feel uncertain about making the right choice and abandon the process.

Case Study: Enhancing the Quote and Buy Journey for a Global Travel and Health Insurance Company

To illustrate how these challenges can be addressed, let’s look at a case study of a global travel and health insurance company. This company faced significant issues with their existing quote and buy journey, which had a conversion rate of less than 1%. Our task was to reimagine and redesign the experience to improve online sales, reduce support calls, and increase customer satisfaction.

Understanding the Customers

Our first step was to deeply understand the customers’ needs, feelings, and motivations. We conducted workshops where users shared their experiences with the current system. Key insights included:

- Eligibility Confusion: Users were unclear why the system would not offer cover in certain territories.

- Data Overload: Users were frustrated by the extensive medical history forms, especially since competitors required less information.

- Product Comprehension: Users struggled to understand which product (bronze, silver, or gold) was right for them.

- Diverse User Needs: Different users (e.g., a doctor vs. a student) required different levels of confidence in the products.

- Cost Awareness: Users were unsure about the medical costs in their destination, affecting their decision-making.

- Technical Language: Insurance-specific jargon confused users, making the process more difficult.

Crafting the Solution

Despite users’ desire for customised products, the company did not plan to change their product offerings. Our challenge was to create a user journey that felt personalised and supportive without altering the core products. Our strategy included:

- Educational Support: We integrated contextual content to help users understand their insurance needs based on their circumstances.

- Streamlined Process: We removed unnecessary steps and irrelevant form-filling to simplify the journey.

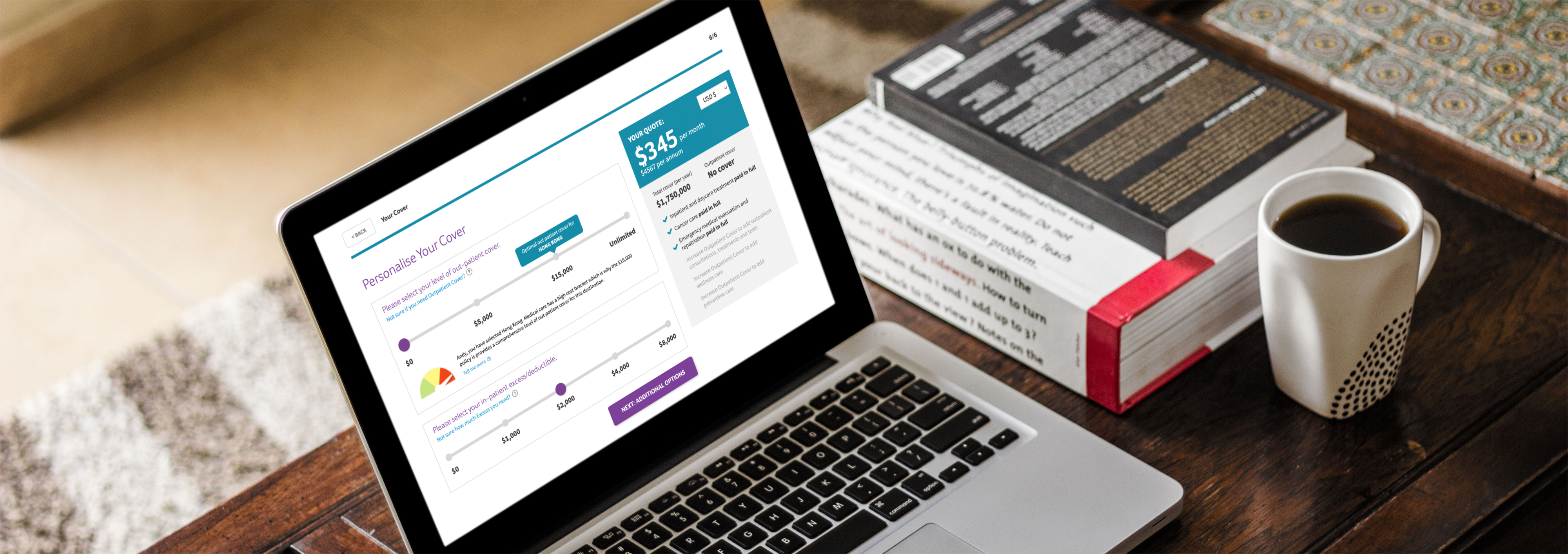

- Perceived Customisation: We designed a system that provided tailored quotes leading to one of the three core products.

- Informative Content: We offered supporting information to help users make informed decisions.

Journey Mapping

We mapped out a simplified journey where users were only presented with relevant information requests. By collaborating with product teams, we identified the key features of each product and aligned them with essential data requirements. This created a conditional, branching journey that adapted based on user input, enhancing the sense of customisation.

Embedded Content

To further support users, we included contextual content without breaching regulatory constraints:

- Risk Information: Videos explaining risks associated with the destination and purpose of travel.

- Medical Costs: Information about health standards and medical expenses in the destination country.

- Social Proofing: Examples of what other users with similar circumstances had purchased.

Prototyping and Testing

We developed an interactive wireframe prototype featuring:

- Streamlined Data Capture: Minimal information requests to shape subsequent steps.

- Dynamic UI Elements: Facilitating a customised experience.

This prototype underwent rigorous testing with users and stakeholders to ensure ease of use and comprehension.

Results

The redesigned journey achieved significant improvements:

- User-Friendly Experience: The new system educated and supported users, reducing calls to the sales team.

- Enhanced Comprehension: Achieved a 100% comprehension rate during user testing.

- Reduced Task Time: The time required to complete the process was significantly shortened.

- Stakeholder Approval: The journey received approval from both the product and finance teams.

- Perceived Personalisation: Users felt that the quotes were personally tailored to them, making the products more appealing.

Conclusion

For product owners in the insurance sector, creating an engaging and high-performing UX for quote and buy journeys is essential for driving conversions and customer satisfaction. By addressing common challenges such as form complexity, product comprehension, and lack of educational support, you can significantly improve the user experience. The case study of the global travel and health insurance company demonstrates how understanding customer needs, streamlining processes, and providing informative content can lead to a successful redesign, resulting in higher conversion rates and happier customers.

Investing in a well-designed UX not only boosts sales but also builds trust and loyalty among your users. As the insurance landscape continues to evolve, staying customer-centric in your approach will ensure that your products remain competitive and relevant.

Looking to improve your quote and buy UX? Speak to one of our experts: Email hello@lionandmason.com or call 020 3740 6260